Pension plans’ financial health flat as strong asset returns strength fail to stem impact of falling bond yields

Aon’s Median Solvency Ratio at end of Q2 2019 stood at 99.3%

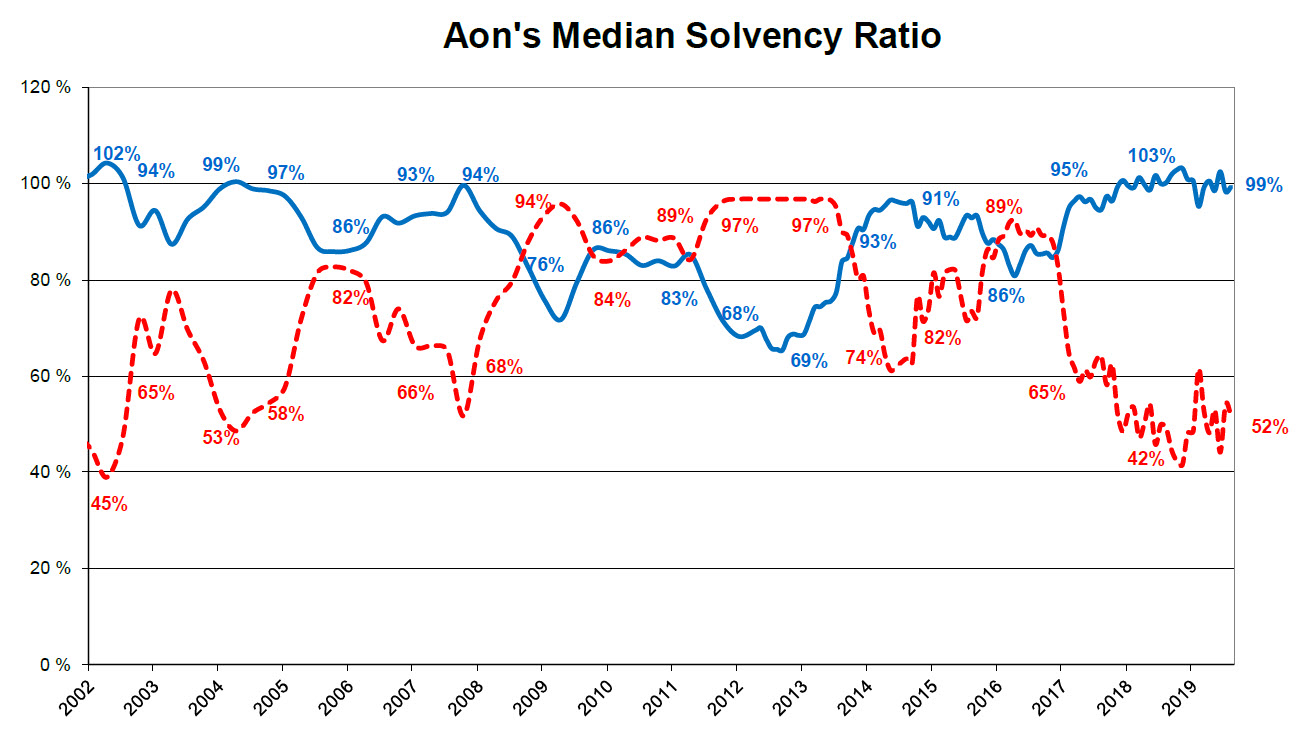

TORONTO (July 3, 2019) – Despite relatively strong asset returns, the solvency positions of Canadian defined benefit pension plans declined slightly in the second quarter of 2019, according to the latest Median Solvency Ratio survey done by Aon, the leading global professional services firm providing a broad range of risk, retirement and health solutions. The median solvency remains high by historical standards but falling bond yields suggest that pension plan sponsors should prepare for volatility ahead.

Quote:

“The liability horse has bolted as bond yields have fallen, and plan sponsors shouldn’t wait for the equity horse to leave the stable as well,” said Erwan Pirou, Chief Investment Officer for Aon’s Delegated Investment Solutions (Canada). “Sentiment is changing direction on a dime. In six months, we have gone from a rising-yield environment, which lowered pension fund liability, to a falling-yield environment, which is increasing liability. Traditionally structured pension plans will struggle to keep up, and sponsors could well miss opportunities to de-risk before it’s too late. The past six months have put the need for speedy and efficient decision-making into a real-world context.”

“Despite the slight solvency ratio decline in the second quarter, the fact remains that the funded status of DB plans in Canada is still high, while many plans are at or getting close to a strategic end state,” said William da Silva, Canadian Practice Director, Retirement Consulting, Aon (Canada). “Given the volatility we have seen over the past few months, it’s arguably more important than ever that plan sponsors review and, where necessary, revise their end-game strategy. Is it settlement? Hibernation? Or perhaps sustainability? With market conditions changing quickly, governance processes have to be agile, because windows of opportunity – and risk – will emerge and close suddenly. Plans will often have to be able to move quickly to take advantage.”

Key Facts:

- Aon’s Median Solvency Ratio increased by 0.8 percentage points in the second quarter of 2019, to 99.3% from 98.5% in Q1.

- 48.2% of plans were fully funded as of July 1, 2019, up 1.2 percentage points since the end of the first quarter.

- As they did for the two previous quarters, Canadian bond yields fell in Q2 2019, with Canada 10-year yields down 24 basis points and Canada long bond yields down 29 bps. Lower yields increase pension plan liabilities, adversely impacting plan solvency.

- Pension assets returned 2.7% in the quarter, compared with a return of 8.5% in Q1.

- In Canadian dollar terms, most equity indices had positive returns, led by the Canadian S&P/TSX composite (+2.6%), the U.S. S&P 500 (+2.0%), global MSCI World (+1.7%) and international MSCI EAFE (+1.4%) indices. The MSCI Emerging Markets index, meanwhile, declined by 1.6%.

- Real asset returns diverged in the quarter. Global infrastructure rose by 1.4% in CAD terms while global real estate declined by 2.3%.

- In fixed income, falling bond yields drove prices higher. The FTSE TMX Long Term Bond Index rose by 4.8%, while the FTSE TMX Universe index rose by 2.5%.

About Aon’s median solvency ratio survey

Aon’s median solvency ratio measures the financial health of a defined benefit plan by comparing total assets to total pension liabilities on a solvency basis according to the different legislations. It is the most accurate and timely representation of the financial condition of Canadian DB plans because it draws on a large database and reflects each plan’s specific features, investment policy, contributions and solvency relief steps taken by the plan sponsor. The analysis of the plans in the database takes into account the index performance of various asset classes, as well as the applicable interest rates to value liabilities on a solvency basis.

Media contacts

For further information please contact the Aon media team: Alexandre Daudelin, +1.514.982.4910.